The Society of Chartered Surveyors Ireland (SCSI) Annual Residential Market Monitor suggests that residential property prices are expected to stay steady for a while, adding that conveyancing is becoming a concern as are ‘false hope’ vacant property grants.

In this article, we cover:

- National average house price increase forecast 2024

- Counties that experienced the greatest house price rises in 2023

- Top three factors influencing house prices

- Reservations on the positive impact of vacant house grants

- How probate and conveyancing processes are impacting property sales

- How homes with high energy ratings command higher prices

Estate agents in the survey predict a small 1 per cent increase in property prices for 2024.

Almost two-thirds (63 per cent) of those surveyed think that property prices have either reached the highest point and will start to go down or are very close to the highest point and will stay there.

The survey – which questioned over 140 SCSI estate agents – points to factors like how many houses are available, changes in interest rates and shifts in the economy as the main reasons for these expectations.

[adrotate banner="56"]Looking back at 2023, the survey found that the median price of a house bought in the 12 months to October 2023 was €323,000, up from €241,000 in early 2013 or an increase of almost €82,000 over 11 years.

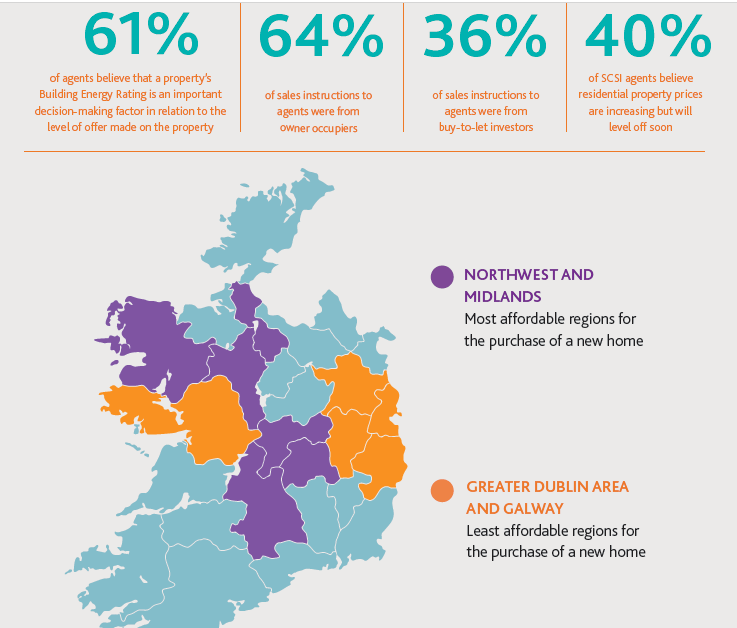

The counties that experienced the greatest price rises in 2023 were Tipperary, Clare, Limerick, Cavan, Donegal, Leitrim, Monaghan and Sligo, with approximately 6 per cent inflation. This is in contrast to Dublin, which recorded an average -0.6 per cent change in prices over the past 12 months.

However, as of December 2023, the Greater Dublin Area remains the most unaffordable region, followed by Galway. The most affordable locations are the Northwest, Midlands and Southeast.

“False hope” from vacant house grants

The SCSI report praised the increased Vacant Property Refurbishment Grant and feasibility grants for farmhouse structures. The grants aim to bring back old stock for habitable use offering up to €70,000.

However, agents expressed reservations about their impact on property sales. Some mentioned that the grants gave buyers “false hope”, leading them to withdraw from sales after researching the complex drawdown process, especially in older houses.

Sales hit by slow probate and conveyancing

Property sales are continuing to fall through due to “inefficient and lengthy” probate and conveyancing processes, the report found.

27 per cent of estate agents surveyed said there had been an increase in the number of sales not going through in the last quarter of 2023. 63 per cent reported that the level of sales not completing remained the same as the previous six months when the issue first came to prominence.

Conveyancing involves the legal transfer of a property title from seller to buyer.

In its analysis, the SCSI found that estate agents are getting increasingly frustrated because things are taking a long time with probate (sorting out someone’s will and estate) and reaching the probate office.

Estate agents also commented on problems with a slow and inefficient process for transferring property ownership affecting sales. Other issues mentioned include problems with planning, not following building rules, disputes over property boundaries and slow lending decisions and approvals/drawdowns from the banking sector.

The SCSI agreed to carry out further research to “explore the significance” of these delays on the residential market which will be considered for future SCSI reports.

BER boost for resale

If, for whatever reason, you decide to put your finished A or B-rated self-build home on the market you can expect a premium on your sale price, according to the report’s findings.

61 per cent of agents believe that a property’s Building Energy Rating (BER) is an important decision making factor about the level of offer made on the property.

The SCSI survey found that there is a widening price gap between energy efficient homes (rated B or higher) and their less efficient counterparts (rated C or lower) due to the time and costs required for retrofit improvements, despite government grants.

Discussing the survey’s findings on RTÉ Radio 1, John O’Sullivan, Chair of the SCSI’s Practice and Policy Committee said that house buyers were attracted to A and B-rated properties due to growing environmental consciousness and attractive green mortgage rates from banks for properties with energy efficient ratings.

“People are environmentally conscious but also very cost-conscious, particularly since the energy and cost of living crisis,” he said.