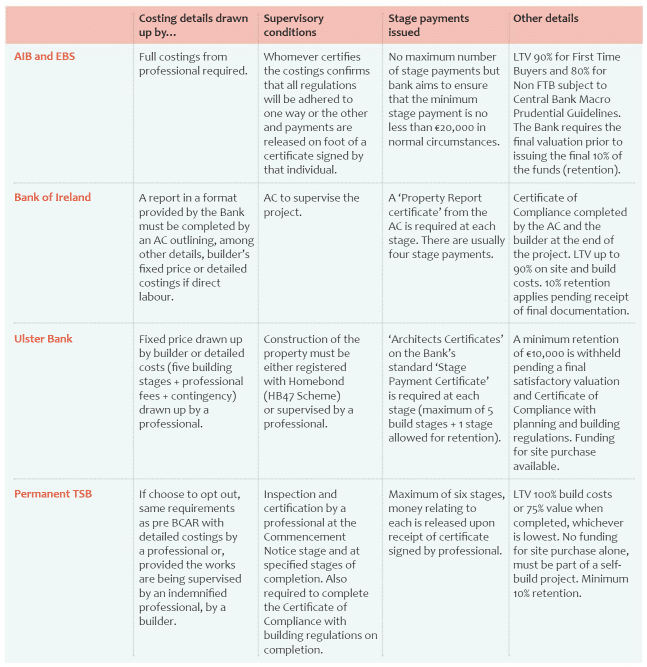

A comparison of what mortgage providers want in ROI.

Remember that even if you ‘opt out’ in ROI, your mortgage provider will in all likelihood require that you have various milestones signed off on by a design professional to release the stage payments. Here’s a roundup of the main banks’ policies in relation to self-build mortgages.

Basic conditions

Registered architects (on the RIAI statutory register), chartered engineers (on Engineers Ireland or ACEI statutory registers) and chartered building surveyors (on the SCSI statutory register) automatically qualify as Assigned Certifiers (AC). Chartered Architectural Technologists are working towards getting on the statutory list but many are also building surveyors and therefore qualify as AC.

The banks arguably do not require an AC but a suitably qualified building design professional (referred to as ‘professional’ in the table below), with Professional Indemnity insurance, to carry out the supervisory functions they require.

However at the time of writing Bank of Ireland required that ACs act as supervisors on the self-build projects they fund, and Permanent TSB does not accept certification from architectural technologists in a self-build scenario. Banks may use this term (AC) to refer to such design professionals but this does not mean that the banks require that you ‘opt in’ to get a mortgage.

All banks listed below accept ‘opt out’ applications on the terms listed, including Bank of Ireland. The banks also require that the property be valued before and after completion of works and that full planning permission as well as insurance be in place.

Note that the bank must be made aware of all onerous clauses, e.g. agricultural clauses, rights of way, etc.

**Details gathered August/ September 2016 by SelfBuild magazine from the financial institutions**

You can opt in or out of the building control amendment at your own discretion but additional requirements apply for each of these loan providers as listed in the table above

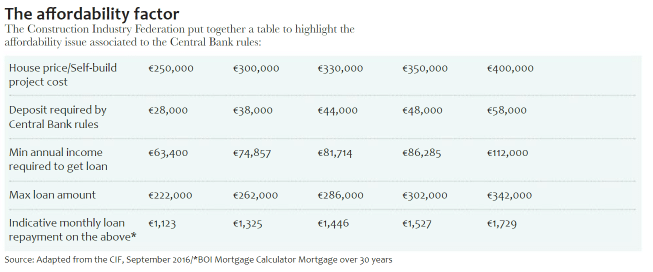

Note that the Central Bank mortgage rules apply to self-build mortgages (maximum LTV 90% for first time buyers on house worth up to €220,000, 80% on the balance and for all other buyers; loan to income level max. 3.5 times full time salary).

What about insurance and property value?

Your construction project will require insurance, there is no way around this. There’s a legal obligation attached and a moral one too. Your lending institution will also ask to see proof that you have adequate cover. But does choosing to ‘opt out’ of the assigned designer/certifier requirement make you more susceptible to be turned down for an insurance quote, or more prone to be charged a higher rate? It’s difficult to get a sense whether this will happen or not.

The opt in vs opt out debate has also raised the question of whether properties would be valued differently; while it’s still early days we did get a reply from AIB about this question in September: “We have not experienced any difference to date or any issues highlighted on the valuations.” The other banks surveyed did not comment.

LTV: loan to value ratio, in other words how much you’re borrowing divided by how much the house is worth in today’s market