A list of grants and financial incentives currently available to help with your self-build or home improvement project in Northern Ireland (NI) today.

In this article we cover:

- List with links of what grants / financial supports are available in Northern Ireland today

- Energy upgrade grants

- What fiscal incentives exist

- What utilities have to offer

- Adaptation grants

- Oil buying clubs

- Low income schemes

When it comes to grants and financial incentives for self-builders in Northern Ireland, the options are unfortunately limited. While there are a handful of schemes aimed at helping homeowners with renovations or upgrades, support for new builds remains scarce.

However, there are still chances to save through tax exemptions, energy efficiency initiatives and local schemes for low-income households or those with specific needs.

1. Feed in tariff for renewables

The Northern Ireland Renewables Obligation Certificates (NIROCs) scheme ended in April 2017, meaning there is no longer a government financial incentive to generate electricity using solar (photovoltaic – PV) or wind power.

[adrotate banner="58"]However, you can still earn money through export payments for energy fed back into the grid to your electricity supplier. To qualify, you must have an NIE Networks import/export meter installed.

Export payments from Power NI are currently set at 10.32 p/kWh and are valid until September 30, 2025

In Great Britain, a different system is in place. The Smart Export Guarantee (which replaced the feed-in tariff scheme) is operational there but does not apply to Northern Ireland.

2. Tax rebates

In Northern Ireland, new builds are exempt from VAT, but you’ll need to keep all your receipts and apply for a refund at the end of the project. This zero VAT rate is available to self-builders (new builds).

If you’re converting or changing the use of a property that’s been unoccupied for at least 10 years, you can also claim back the VAT. Homes that have been vacant for two or more years before work begins qualify for a reduced VAT rate of 5% — you can find a useful FAQ about this here.

There’s also a zero VAT rate for work carried out for people with a disability or terminal illness. For those over 60, the reduced 5% VAT rate applies to mobility aids, heating upgrades and security improvements.

3. Oil buying club

Group with your neighbours to get a better deal from oil suppliers to fill your tank. More information on the NI Oil Buying Network (OBN) here. Average savings are currently £10 – £30 on 200 litres of oil for OBN members.

4. Housing Executive grants

There are several grants available for homes in serious need of repair, though they can be difficult to qualify for. If you own a historic building, Ulster Architectural Heritage has a useful guide to the grants you may be eligible for.

For those with mobility or disability needs, the Disabled Facilities Grant can cover all works recommended by an Occupational Therapist, typically up to £35,000 (with an absolute maximum of £70,000). This grant can be combined with a Replacement Grant, which provides up to £31,500 for a home of up to 80sqm.

If your total annual gross income is under £23,000, you might qualify for the Affordable Warmth Scheme, managed by the NI Energy Advice Service (NIEAS). For more information, you can call 0800 111 44 55 or email NIenergyadvice@nihe.gov.uk.

While there are more grant options, many can be hard to get. You can find more details on NIHE grants here.

5. Low income schemes

Bryson Energy in partnership with Belfast City Council runs a handyman service for the elderly. More here.

There are additional grants available through the Utility Regulator’s Northern Ireland Sustainable Energy Programme which has been extended for two years, from April 1, 2025 until March 31, 2027. Details for the schemes in operation until March 2025 are below (to be updated):

Many of these measures are fully funded, covering upgrades to efficient heating systems and insulation improvements. However, they are only available to low-income households, defined as single-person households with an income or pension below £28,000 before tax, or couples/single-parent families with an income or pension below £35,000 before tax.

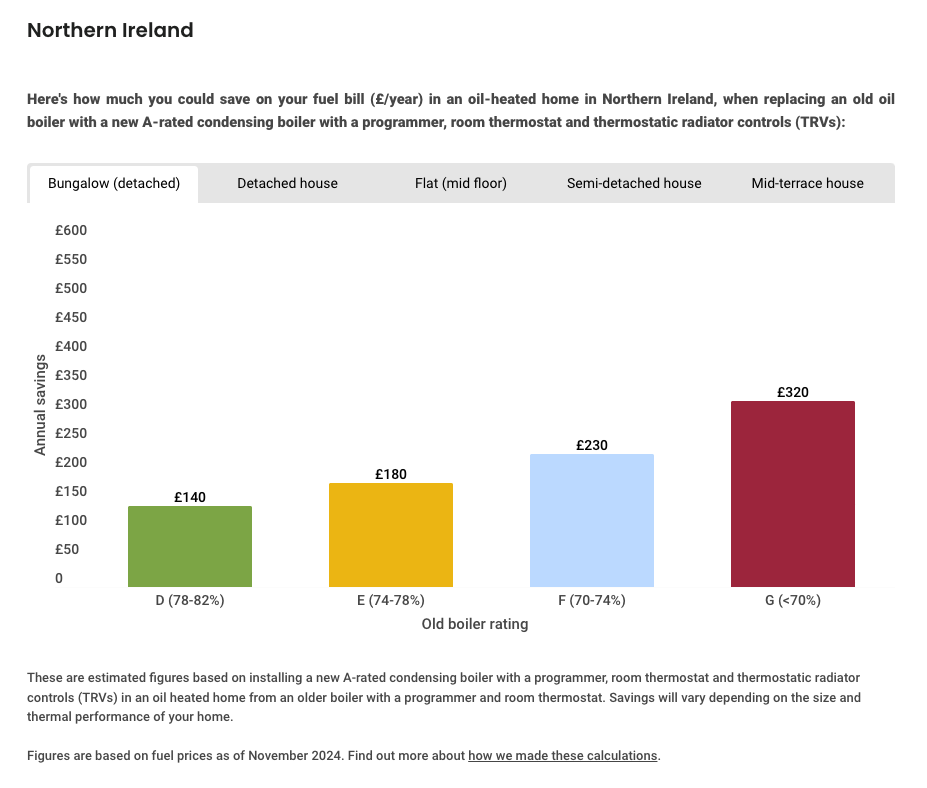

Savings to be made in NI with replacing a boiler are available from the Energy Savings Trust, as below:

Disclaimer: This list is not exhaustive, always consult with a qualified building professional. Schemes are subject to change.

Last update: December 2024