New thresholds for stamp duty are being introduced in NI as the Executive calls for greater control over its budget.

In this article we cover:

- How much stamp duty you need to pay for your new build

- Current vs previous thresholds

- First time buyer exemptions

- Devolution of fiscal powers

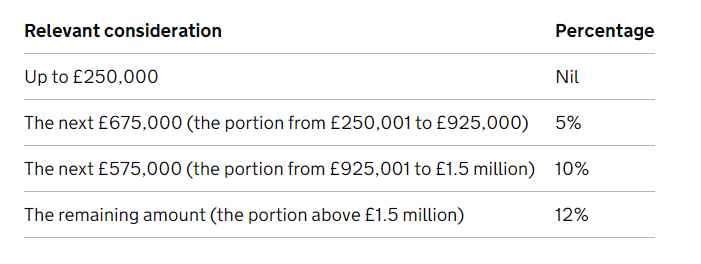

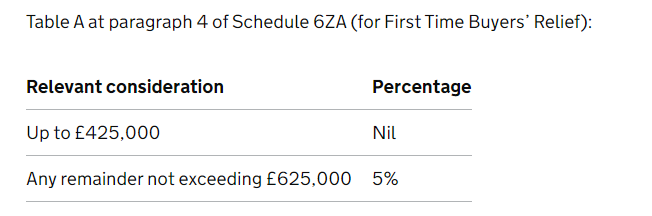

The UK mini-budget increased the threshold at which you start paying stamp duty land tax (SDLT) on residential properties, from £125k to £250k. First time buyers only have to pay stamp duty on properties valued £425k upwards (previous threshold was £300k).

The mini-budget proved controversial in the UK and has led NI Finance Minister Conor Murphy to say the UK Chancellor had to take “a completely different approach”. “The mini-budget is already set to increase mortgage costs for thousands of homeowners,” Minister Murphy said.

This measure was initially announced on 23 September 2022 as a permanent change. At Autumn Statement 2022, the government announced that the increase in the residential nil-rate threshold will end on 31 March 2025. It doesn’t apply to Scotland or Wales, where devolved land transaction taxes apply, but applies to Northern Ireland.

[adrotate banner="56"]

Devolution of fiscal powers

Separately, the NI Finance Minister launched a public consultation calling for the devolution of fiscal powers to the NI Executive. The proposal is looking to align the NI model to the one in operation in Scotland and Wales.

“The Executive is responsible for less than £1 in every £20 of tax revenue raised locally,” he said. “As a result the Executive is hugely dependent on a block grant which is being squeezed by Westminster, threatening the sustainability of our public services.”

“As a result the Executive is hugely dependent on a block grant which is being squeezed by Westminster, threatening the sustainability of our public services. The Scottish and Welsh Governments have more control over their tax affairs and it is time for a mature discussion on the potential benefits of greater control over taxation here. This discussion is all the more vital given that the Westminster government is embarking on a course of massive tax breaks for the wealthy which will reduce funding for public services and create more inequality.”

Minister Murphy continued: “The Fiscal Commission’s report has started a conversation around what additional fiscal powers could be provided to an Executive to allow locally elected Ministers to set taxes in line with local needs and circumstances. While it will be for an incoming Finance Minister to bring recommendations on this matter to a restored Executive, it is important that the public has its say. I encourage individuals, businesses and civic society to contribute to the consultation.”

The proposal is out for public consultation until November 29.

Commenting on the budgetary position, Minister Murphy said: “With no budget to help Departments plan, the Westminster Government’s mini-budget not providing additional money for public services, and inflationary pressures, our finances are now in a critical position.

Separately, the Minister added: “Despite assurances that replacement funding would come in full, this has not happened. As a result many projects which play a vital role in our communities face huge uncertainty.”

“We have lost £65 million per annum from the Executive budget. What little replacement funding there is will be spent directly by the British Government, according to a plan they have developed, bypassing local departments.”

“The British Government must replace EU structural funds in full and ensure the continuation of this vital funding.”